The Nigerian government, under President Tinubu’s leadership, is making significant changes to the country’s tax system. Their goal? Increase the nation’s tax revenue from 11% of the GDP to 18% within three years. While the objective is to ensure the rich contribute fairly, it raises a question: Haven’t the wealthy been paying more all along?

Consider the Value Added Tax (VAT). This tax affects all stages of production. Any hike in VAT increases costs for business owners. In 2019, the Federal Inland Revenue Service noted that a higher VAT means the rich will pay more. The exemption of basic food items like salt from VAT already suggests the tax focuses on items, more patronised by the rich.

In 2022, there was a significant debate around VAT. State governors proposed doubling it to support pensioners. However, the Nigerian Labour Union argued that such a move would unfairly burden the poor. Instead, they advocated for taxing luxury goods and lifestyles more, which predominantly targets the wealthy.

The recent decision by the federal government to potentially lower the corporate income tax is a positive step. This change aims to encourage businesses and foster economic growth. But here’s the catch: Nigeria’s tax revenue in comparison to its GDP is much lower than the average for Organisation for Economic Co-operation and Development members. With only a fraction of registered firms and individuals actively paying taxes, the system suffers gaps.

The Risks of Over-Taxing the Wealthy

While supporting businesses is crucial, placing the tax burden mainly on the wealthy poses risks. History shows that high taxes can lead the rich to find ways to shield their wealth or even avoid taxes altogether.

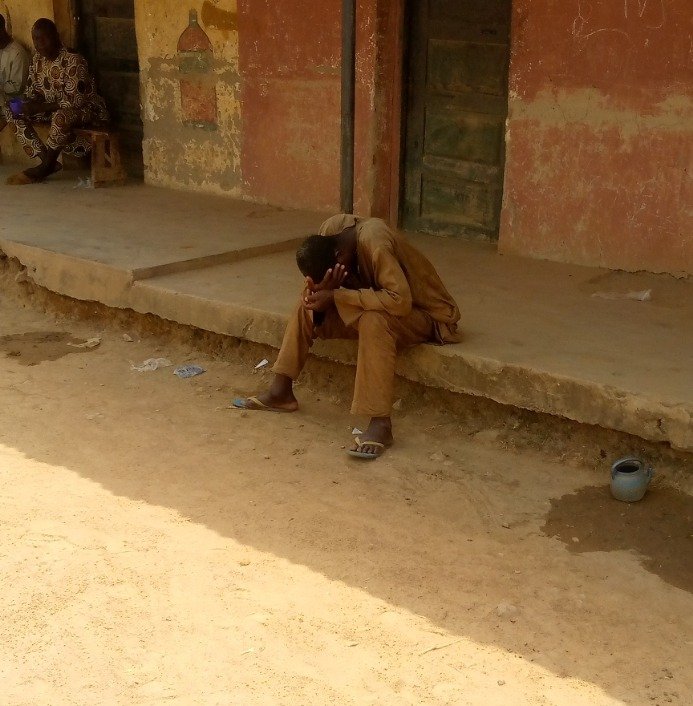

Furthermore, Nigeria faces other economic challenges. The National Bureau of Statistics highlighted an unemployment rate of 4.1% in early 2023. With such challenges, Nigeria should be focusing on creating a welcoming environment for investors. Over-taxing the rich might drive them away, seeking friendlier economic climates.

Tax reforms are essential for Nigeria’s growth. However, a balanced approach is necessary to ensure the nation’s prosperity. Over-taxing one group might bring short-term gains but could deter long-term growth and stability. The focus should be on creating a fair system for all and fostering an environment where businesses and individuals thrive.

Dear Advocate of Reasoning, should the government tax the rich more?

To learn more about this topic, read our coverage on Nigerian Rich Are Taxed Enough.

This is Voice of Reasoning and this is from The Liberalist.

Stay free and keep reasoning.