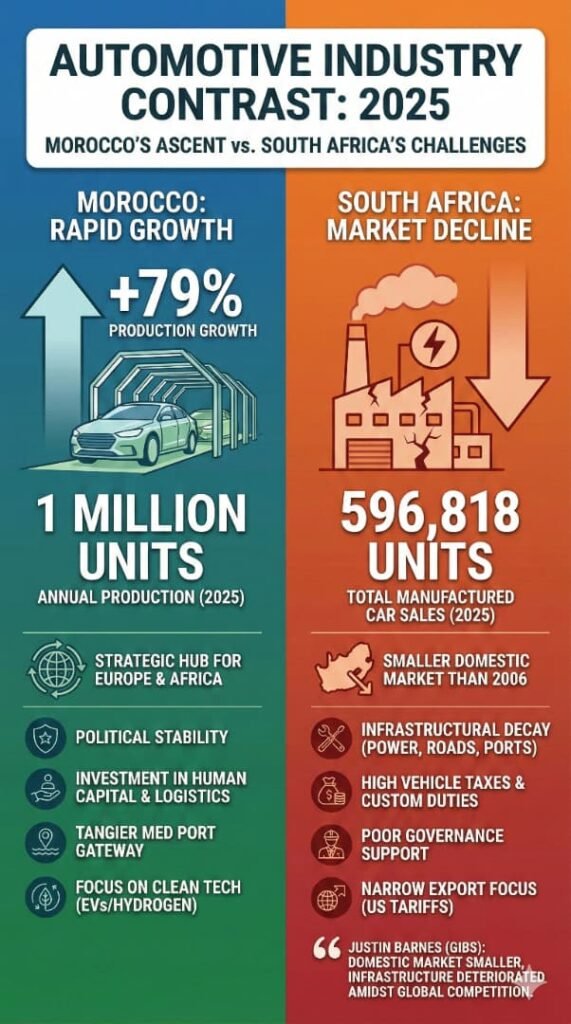

Last year, Morocco became the leading car manufacturer in Africa dethroning South Africa who had held the position for years. Factors like low taxes and levies for manufacturing companies and an enabling environment for foreign investment drove the rapid rise of the country’s automotive hub.

In 2025, Morocco produced one million cars, surpassing the 559,645 cars manufactured in 2024, representing about a 79 percent increase in productivity. This milestone ignited massive economic growth for the country, boosting its export market, which analysts project at ₦40 billion annually.

“We didn’t export one car 15 years ago,” Ryad Mezzour, Morocco’s Minister of Industry and Trade, said. “Now it’s the first exporting sector in the country.” But the sector’s growth does not stand alone. The Moroccan government made a number of flexible policies to drive this growth.

Policy and Investment

A report shows that the government’s free market policy under its 2014-2020 Acceleration Plan serves as the key metric supercharging Morocco’s automobile growth. The plan led to the establishment of strategic automobile free trade zones in Tangier Automotive City. While the city became a commercial hub, growing numbers of foreign investors trooped into the country, and major production companies such as French automaker Renault Group and Stellantis Group settled there.

As part of the policies under the Acceleration Plan, the government exempted manufacturing companies from paying tax and custom duty. The state allows many automotive companies to operate without excessive market repression. Additionally, the Moroccan government signed free trade agreements with Europe, the USA, Turkey, and the United Arab Emirates, further strengthening the country’s foreign economic collaboration.

The government equally created vocational training institutes in Casablanca, Kenitra and Tangier to elevate the skills and manpower of workers, coupled with expanding land donation to the manufacturing sector.

These policies, all geared towards creating an enabling environment for the car manufacturing industry, work together to position Morocco as the top car manufacturer in Africa and renowned exporter. As of 2025, the country exports 90 percent of the Renault cars it manufactures to over 68 countries.

What About South Africa?

In contrast, while Morocco’s annual production grew by 79 percent in 2025 to reach one million units, South Africa’s industry only sold 596,818 manufactured cars, about half of Morocco’s in the same year. Experts attribute South Africa’s market fall to a myriad of problems, including infrastructural decay, high taxes and custom duties.

Global Fleet said South Africa’s automotive industry hit a hard rock due to poor governance support, high vehicle taxes hindering local demand, and a narrow concentration on a few markets like the US, which later imposed heavy tariffs on the country.

Justin Barnes, Director of African Industrialisation Service and Gordon Institute of Business Science (GIBS), revealed that the country now has a “domestic market that is smaller now than it was in 2006, and we have local and national infrastructure which has deteriorated at exactly the same time that we have seen tremendous improvement in other emerging regions of the global automotive industry.”

In the meantime, Morocco continues to reap the fruit of its free trade policies. One of the country’s most profound benefits involves the elevation of job creation, employing over 180,000 citizens across the country, with Renault targeting 7,500 job opportunities by 2030.

“All these achievements have made Morocco a prosperous and safe environment for business,” Chakib Alj, the president of General Confederation of Morocco Enterprises (CGEM), stated. “By choosing Morocco, an investor chooses growth, innovation, visibility, and stability. The investor also chooses to access a growing continent with a promising future.”