For decades, Nigeria has been at the heart of the global shea industry, producing nearly 40 percent of the world’s shea nuts. Yet, despite this dominance, the country only benefits just 1 percent of the $6.5 billion global shea market. This imbalance, long accepted as a symptom of Nigeria’s dependence on exporting raw commodities rather than advance value addition, is now facing a reckoning.

That was what President Bola Tinubu attempted last month when he ordered a temporary six-month ban on the export of raw shea nuts, in what the government described as an attempt to shift Nigeria from a supplier of raw materials to a producer of refined shea products. Vice President Kashim Shettima framed the policy as an opportunity to grow the shea value chain from its current $65 million to nearly $300 million annually in the short term, with a tenfold leap projected by 2027.

The logic behind the ban is to redirect Nigeria’s shea harvest into domestic processing plants that can churn out butter, oil, and other derivatives demanded by the international confectionery and cosmetics industries. But the government’s six-month embargo was announced without a clear transition plan and inevitably sent shockwaves through the shea market, leaving farmers and exporters scrambling to adjust overnight.

Though some state governments are moving to fill the gap. For instance, the Niger state government recently unveiled a plant capable of processing 30,000 metric tonnes annually, while Kwara state is building another facility designed to handle 50 tonnes daily. The hope, according to analysts, is that such efforts will absorb at least part of Nigeria’s 1 million metric tonnes of annual shea output.

But on the ground, optimism is tempered by reality. “The idea of growing the local industry doesn’t happen overnight. You don’t set up a processing industry within two months,” said Rildwan Bello, chief executive officer of Vestance, a Lagos-based agricultural consultancy. The current infrastructure, he and others argue, is inadequate to support the kind of transformation the government envisions.

Meanwhile, Kabir Ibrahim, president of the Nigeria Agribusiness Group, says Nigeria’s role in the global shea market has been limited to cultivation and export. He noted that for decades, Nigeria has played one key role in the global shea market: cultivating shea trees for yields so it could trade them off more than 90 percent to be refined outside the country and then repurchase them at premium prices.

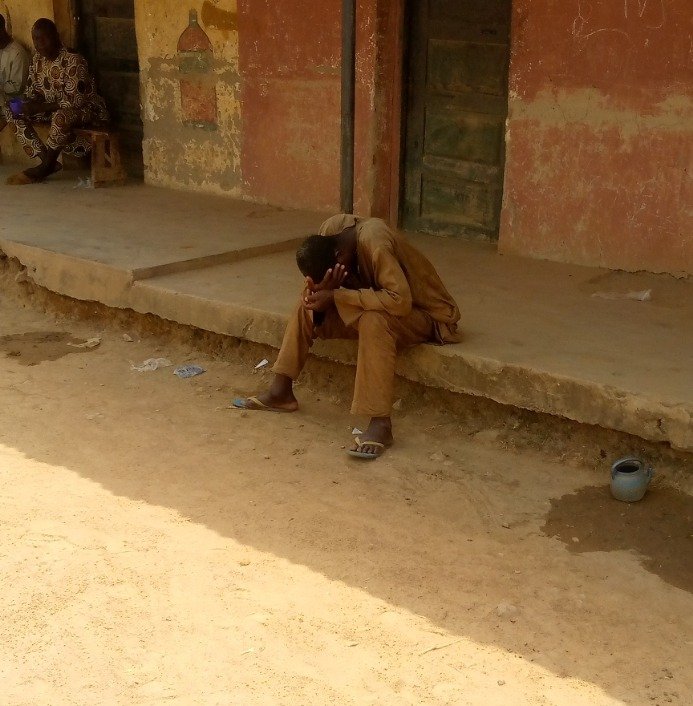

However, women, who form over 95 percent of shea pickers and processors, often work in informal setups, roasting and grinding nuts in their homes, with little access to modern equipment or credit. Hajiya Nana Shettima, the wife of Nigeria’s Vice President, assured that the ban, if well implemented, would grow the local economy and empower women who work in the industry.

“Shea has the potential to become Nigeria’s untapped goldmine,” said Eniola Akindele of the Presidential Food Systems Coordinating Unit.

Sudden Ban Triggers Market Volatility

But despite widespread acceptance of the ban, the risks are mounting. Farmers and exporters caught in the sudden policy shift felt the impact almost immediately. Within 24 hours of the ban, the price of shea nuts dropped from ₦1 million to ₦800,000 per tonne, a 33 percent plunge that left many worried about defaulting on contracts.

“Exports made the market vibrant. Local demand is not as high as local supply,” said Bello.

Critics argue that the government has not paired the ban with mechanisms to ease the transition. Dele Oye, Chairman of the Alliance for Economic Research and Ethics, said the abrupt decision raises serious concerns about livelihoods and investments. According to him, the hasty implementation without adequate transition and sector-wide consultation could threaten actors in the shea industry.

Beyond infrastructure, the sector continues to face systemic obstacles, from poor energy supply to weak financing options, and high production costs.

Grace Ajayi, an agricultural extension expert at the University of Abuja, warned that unless these constraints are tackled, “farmers and collectors may suffer losses because processors won’t be able to buy all the supply.”

The export ban reflects a recognition of Nigeria’s failure to capture its fair share of the global shea market. But without reforms that expand refinery capacity, improve access to finance, and modernise local processing, experts noted the policy risks repeating the very cycle it seeks to break and further leaving farmers, vulnerable women under-supported, and Nigeria’s shea industry once again at the mercy of external markets.