Africa’s prosperity is beginning to rise again after years of uneven growth, but the gains remain heavily constrained by fragile political and economic freedoms, according to the Freedom in Africa Report (F[in]AR 2025).

The index, which evaluates the state of freedom and prosperity across the continent, shows that although recent improvements signal resilience and recovery, weak institutions, limited economic liberties, and persistent governance challenges continue to hold back broad-based progress.

According to the index, Africa recorded modest improvements in 2020, signalling progress in business regulations and openness; the continent’s economic freedom later collapsed due to rising taxes, currency instability, and excessive state intervention in key sectors.

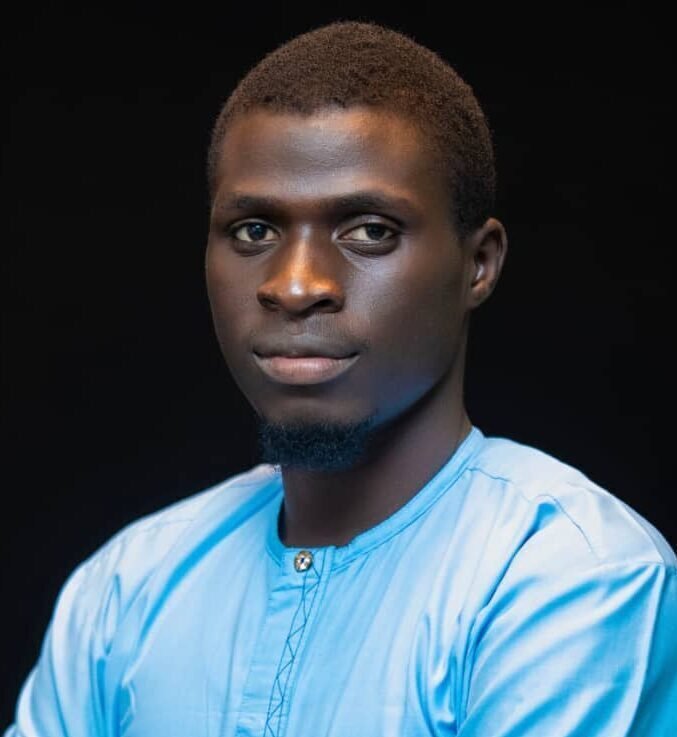

F(in)AR, launched on October 25 at the Conference of Freedom Advocates (CFA) in Abuja, is an initiative of the Liberalist Centre, a policy and research think tank dedicated to advancing liberty and prosperity across Africa. The report offers a comprehensive overview of the continent, examining how rights, opportunities, and outcomes intersect across Africa’s diverse economic and political landscapes.

It assesses freedom and prosperity through three interconnected dimensions: political freedom, economic freedom, and prosperity. Although the report did not collect raw or primary data, it draws from globally recognised datasets that provide standardised and internationally comparable indicators. According to the methodology, indicators were selected based on conceptual relevance, data reliability and coverage, and comparability and transparency.

Indicators Reveal Deep Structural Weaknesses

Economic freedom in F(in)AR is indexed across seven core indicators: property rights, ease of starting business, trade openness, free movement, digital economy, taxation, and labour market freedom. The continent’s score rose from 53.9 in 2020 to a peak of 56.4 in 2022, reflecting regulatory improvements and greater business openness. However, this progress reversed sharply, dropping to 43.2 in 2024 and 42.8 in 2025, signalling widespread regression and declining confidence in economic governance.

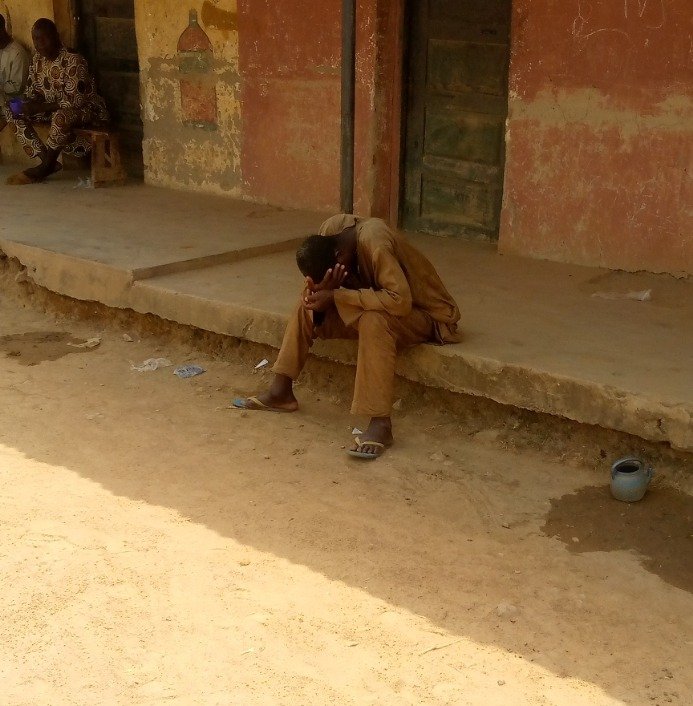

Across these indicators, the continent continues to struggle with creating a business-enabling environment. On property rights, F(in)AR emphasises that the ability to own, transfer, and secure land or property significantly influences how citizens accumulate wealth, invest in their future, and pass on opportunities to the next generation. However, this right remains weak, with an average score of 4 out of 10, indicating that millions lack land ownership and posing a major barrier to investment and wealth creation.

The report concludes that until stronger protection laws and policies are enacted, ownership security will depend less on the law itself and more on political discretion, keeping property rights a barrier to prosperity in most regions.

On labour market freedom, which measures how easily people can work, hire, or be hired, Africa scores an average of 5 out of 10, suggesting moderate flexibility but persistent informality. Interestingly, the continent performs relatively well on taxation, scoring 8 out of 10, indicating that most countries maintain manageable tax burdens. F(in)AR warns that excessive taxation discourages entrepreneurship and could stifle private-sector growth if not balanced effectively.

The report also notes that freedom of movement remains inconsistent, with an average rating of 5 out of 10. Despite regional frameworks like the ECOWAS visa-free protocol, Africans still face significant travel barriers within their continent. Only a few nations, namely Benin, Gambia, Rwanda, Ghana, and Kenya, have eliminated visa requirements for all African travellers. Poor infrastructure and insecurity further restrict movement, making trade and travel both costly and risky, according to the report.

Trade openness, a central driver of prosperity, remains weak, F(in)AR reveals, with an average score of 6 out of 10. Intra-African trade remains limited due to tariffs, poor logistics, and inconsistent policies. Economies like South Africa, Kenya, and Morocco benefit from more open trade frameworks, while conflict-affected countries such as Libya, Somalia, and South Sudan continue to lag behind. Although the African Continental Free Trade Area (AfCFTA) is cited as a potential game changer, F(in)AR cautions that without harmonised customs rules and stable borders, regional integration will remain largely aspirational.

The top performers in economic freedom include Mauritius, Botswana, Cape Verde, South Africa, and Seychelles. Mauritius ranks first, with an average score of 8 out of 10, reflecting an impressive level of economic freedom. A recent example underscoring this success is the government’s 2025–2026 budget reform, which simplified business licensing and immigration procedures. The reform introduced a new Lodging Accommodation Permit for hospitality operators, extended tourist-enterprise licences to three years. It also launched a digital platform, in collaboration with the Economic Development Board of Mauritius (EDB), to streamline Occupation Permit applications. These reforms have strengthened investor confidence and boosted business efficiency.

In contrast, fragile states such as Somalia, Libya, and South Sudan demonstrate that without peace, security, and the rule of law, economic freedom remains unattainable.

For example, despite formal reforms, businesses in Somalia face severe structural barriers. According to the U.S. Commerce Department’s country guide, Somalia continues to grapple with rampant corruption, weak governance, and almost non-existent enforcement of contracts and property rights. These conditions stifle entrepreneurship, discourage foreign investment, and limit economic diversification. Although Somalia possesses significant resource and logistical potential, F(in)AR notes that its economy remains highly informal and unpredictable, underscoring how insecurity and institutional fragility keep economic freedom out of reach.