It was 7:30 am on Thursday, 16th February and John Okoro was already at his laundry shop at Okpuno, Awka South Local Government Area of Anambra State, to begin the day’s business. He has been in the laundry business for almost five years, but “had never found the current situation in the country this difficult,” he said.

“The economy is very bad with epileptic power supply and hike in prices of goods. I have machines and pressing iron which need a power supply. So, with constant power, I make more profit. But that’s not the case. Now that I buy fuel at the rate of N450 naira, it affects the business. We also pay for unreliable electricity. I now work like an elephant and eat like an ant,” he lamented.

Beyond those challenges, John still battles other problems. “The state government imposes too much tax on us. During the past administration, we paid N2000 for the environmental fee. The business permit was N1500. Now, the environmental fee is N4500 while the business permit is N7000.”

“After removing the money for fuel, electricity as well as taxes and levies, you discover you are working for the government,” John remarked with disapproval. “It is affecting me badly. I am not making profits like before. The last time I bought fuel at the price of 1500, I could not even use it to make a profit of 2000.”

Unlike John, Felix Ndu (not his real name) who sells shoes, said the business atmosphere in the area is unfavourable. “We are talking about naira scarcity, fuel scarcity, inflation, and sky-rocketing prices of items. Yet, we are asked to pay two times what we used to pay. Any reasonable and compassionate government would have considered all these.”

“During the previous administrations, their tax system and mode of enforcement were not detrimental to the people and their businesses. But presently, the taxes are higher and the mode of enforcement is not civil.”

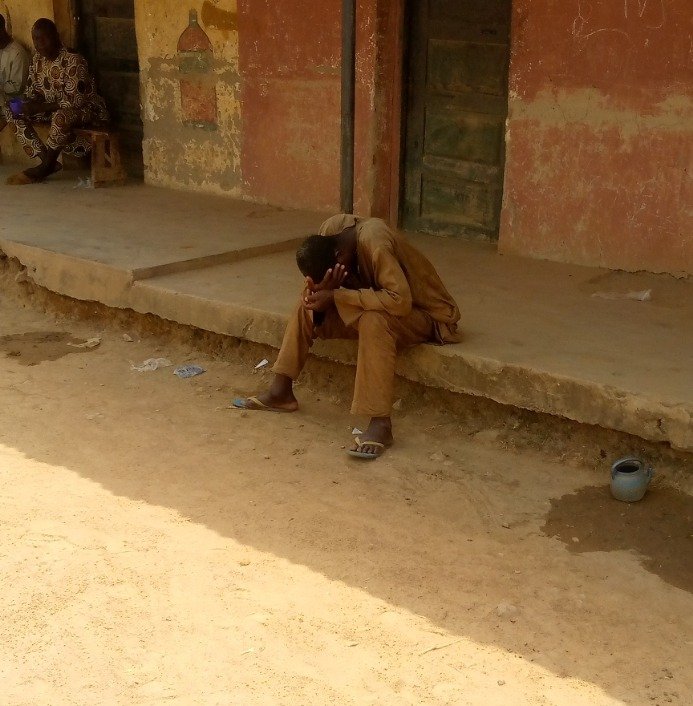

With an increment in the amount of taxes and levies paid to the government and the inflation in the prices of consumables and other necessary items, many Nigerians struggle with their financial lives.

Peter is one of those people. As he plies his trade within the popular Eke Awka market, trading in home and kitchen utensils—a business he has been doing for over two decades, he said he could not understand why those elected by the people turn against them afterwards.

“Even if you cry from today till tomorrow, the people in power don’t bulge. During the previous administration, we were paying N2500. It later rose to N5400 and later to N8000. From N12,200, this professor has increased it to N14,200.

“If anyone tells you that this government is favourable to him or her, the person is working with the government,” Peter concluded.

In Onitsha, the commercial nerve centre of the state, Julius Obi is a small-scale entrepreneur. And he doubts whether he works for the government or himself.

“Things are no longer like they were before. For you to struggle with the little you are earning to settle all these things, taking care of the family is even a problem”.

“Honestly, sometimes, it bursts the head,” he responded. “They keep bringing papers demanding payment. And before you arrange yourself to pay, you see hoodlums coming to embarrass people.”

Taxation, lawful citizens’ obligation

The collection and administration of taxes are regulated by several laws at all levels of governance in the country. Such laws, which are amended periodically, establish the administrative body, specify jurisdictions, and impose tax at a predetermined rate on specified income, profit, gain, and value of transactions of taxable persons.

In Anambra, the Revenue Administration Law 2010 empowers the state Internal Revenue Service to assess all taxable persons in the state as well as collect, recover and pay to the designated account any tax due to the state government. The Service is equally empowered to examine and investigate tax fraud and evasion with the assistance of law enforcement agencies.

According to section 59, any person who fails to pay any tax, levy, rate, charge or other revenue due to the state or local government authority in full is guilty of an offence and shall be liable upon conviction to a fine of 1% of the total amount of the revenue which was due and payable for each day of default and imprisonment for six months.

Section 65 prescribes a one-year prison term for any person who connives with any other person to contravene any of the provisions of the law, while any person who contravenes provisions for which no specific penalty is provided, by section 69 sub-sections 1, is guilty of an offence and on conviction liable to a fine of N50,000 or imprisonment not exceeding six months or both.

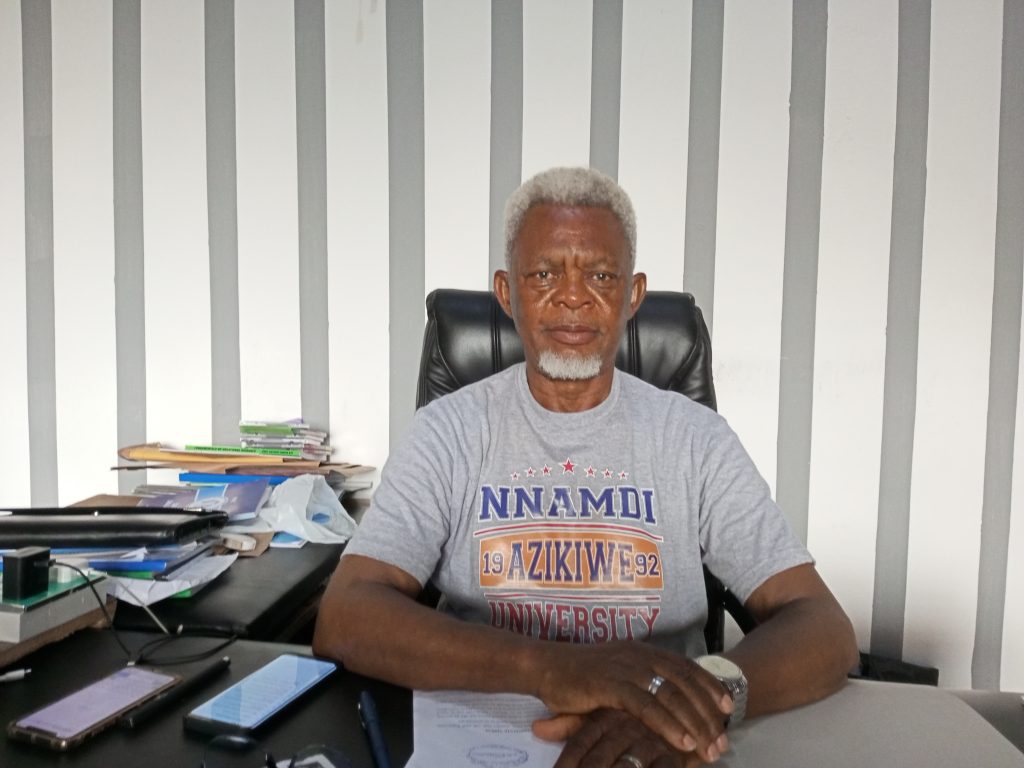

“Apart from being a civic duty, the government needs tax to accomplish some of its set goals. Another one is the economic reality in the country. For instance in Nigeria, the oil money is dwindling and there is an increasing need for internal generation of revenue,” said Prof. Uche Nwogwugwu, an economic expert and professor at the Nnamdi Azikiwe University.

The Chairman, State Internal Revenue Service, insisted that no government could survive without taxation. He also recommended strict enforcement of tax laws.

“I tell you – those laws when properly applied would increase revenue generation and increase the pace of development. Taxation ensures that the man or the woman in the society is fully involved in the running of the government”.

While the people are aware of the tax obligations on them, they believe the government should not exercise this power in a way that will consume all their profits and make life and livelihood difficult for them. Many business owners see excessive taxes on their businesses as a way the government generates revenue at the expense of their economic survival.

Nnewi is fondly referred to as the “Japan of Africa” because it is home to many manufacturing companies including Innoson Vehicle Manufacturing, (IVM), Cutix Plc, Ibeto Group of Companies, Chikason Group of companies, and Coschris Group among others.

There are also several small-scale businesses and startups hoping to survive the mucky business climate and blaze into the reckoning. An entrepreneur, Dominion Udorji, said, “Tax is good. It’s for development. We have been paying it without grudging. But, Soludo just came and increased everything. Now, to offload, you pay N30,000, and to move your goods, N30,000. You pay for the shop, and waste management. Nobody will tell you something good about this tax increment in Anambra.”

“All the payments I make, I calculate them and put on the goods I sell. And when the price of goods goes high, people don’t buy. It reduces my profit. From Nkwo-Nnewi here to another point, they will charge you high because they pay N1,500 every day to the government”.

He regretted that the Governor did not fulfil his promise of battling thuggery in the state. “He said he would stop the thugs (agberos) from harassing the citizens. But, he just refined it, changed the name and empowered the same old touts against the masses. They come and are ready to fight you to death. They don’t care how you survive with your family.

“I assume that for someone to be employed by the government, that person must be educated to be able to follow things the right way. But these ‘tax enforcers are so aggressive. Before you ask one or two questions, they might even slap or beat you up. It’s disturbing,” Julius sadly remarked.

‘Lose the rope on them’ – University Don Pleads

Despite the explanations by the government, Professor Nwogwugwu advised the government to be diplomatic in the implementation of the tax policy.

“Using people (touts) who were earlier dislodged, is like adding salt to an injury. These young ones are desperate to meet their target. I appeal to the state government to re-examine the economic hardship in the land.”

“I agree, you want to develop the state. But, the enforcement should be gradual. We have gaps in tax payment here, especially in the informal sector. You cannot change that overnight,” Nwogwugwu noted.

Tax Relief, Tax Reduction Are Economic Wise

Four months ago, following a state-wide outcry against the tax policies, Governor Chukwuma Soludo exempted the wheelbarrow pushers, vulcanizers and other petty hawkers from the tax net.

The Governor also in January 2023 suspended taxes imposed on heavy-duty vehicles for loading and off-loading and reduced the N15,000 monthly payment by tricycle riders to N10,000 while shuttle bus drivers now pay N12,000 as against the former N25,000.

This move by the state government allows the citizens to believe that the government is knowledgeable enough to know the impact of the taxes on the people. But when the taxes remain burdensome for other SMEs, the effect is that it would discourage the young ones from starting new businesses.

“For example, if you want to open a business after you have been subjected to pay those charges, you feel like opening the business is for the government. It is of no use to you. It takes courage for people to open a new business now,” said John.

“An average Igbo man has a made-up mind to succeed at all cost, even if a dollar is exchanged at three thousand naira. The situation in Nigeria generally is not encouraging for startups. But, whether encouraged by the government or not, people are determined to succeed.”