To alleviate the impact of Nigeria’s escalating cost of living, the Presidential Fiscal Policy and Tax Reforms Committee, led by Chairman Taiwo Oyedele, has put forward a series of tax reforms. Among the proposals, he said, is a significant reduction in the Value Added Tax (VAT) to 0 percent on essential items such as food, healthcare, education, and exemptions for rent, transportation, and small businesses.

This initiative could breathe life into Nigeria’s struggling economy, offering relief to businesses and consumers. Studies have shown that reducing the tax burden on essential goods and services can create a more favourable environment for businesses to thrive, drive innovation, and ultimately, bolster the nation’s economic health.

In contrast, Stransact, an independent audit, tax, and consulting firm, warns against the dangers of excessive and multiple taxes, which can create an unfriendly business environment, stifle investment, and lead to the closure of businesses. Small and medium-sized enterprises (SMEs), in particular, are vulnerable to the effects of over-taxation. High taxes increase the cost of doing business, forcing companies to pay multiple levies to different levels of government, thereby inflating operating costs and squeezing profit margins. This scenario makes survival difficult for businesses, especially in tough economic times.

“Multiple taxation leads to reduced competitiveness,” the Stransact report notes. “When businesses are subject to multiple taxes and levies, it reduces their ability to compete with businesses operating in other countries.”

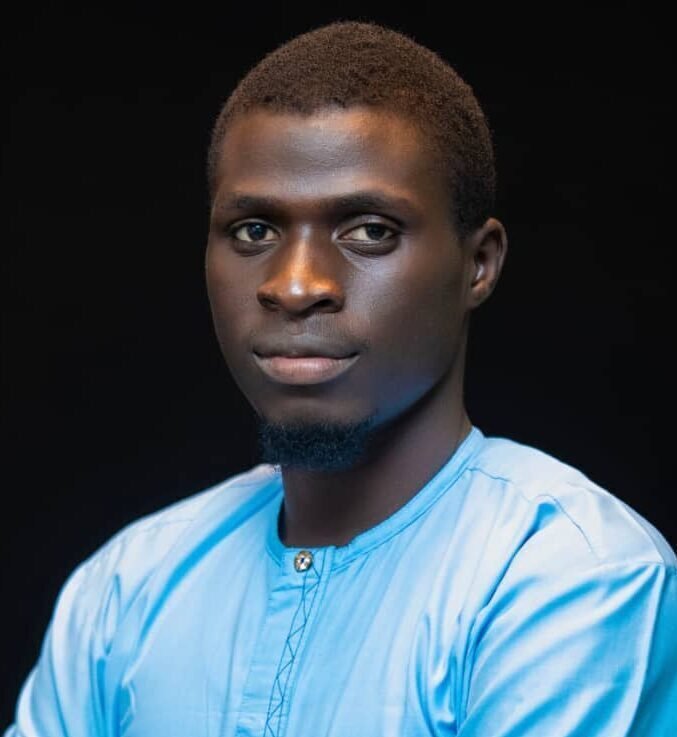

Mr. Oyedele acknowledged these concerns, emphasising that the committee has carefully considered which basic necessities should be tax-free.

“We’ve deliberately identified items such as food, accommodation, transportation, education, and health, and removed almost all taxes applicable to them, including VAT. We believe this approach will make these basic necessities more affordable for Nigerians,” he explained.

Oyedele also highlighted the importance of not overburdening the informal sector with taxes, viewing it instead as a “massive opportunity to drive growth and create wealth.” He advocated for nurturing these businesses as “seeds for inclusive development in the medium to long term.”

In a related move, the committee is also proposing an increase in VAT from 7.5 percent to 10 percent by 2025 for goods and services not covered by the reduction. VAT, a consumption tax levied on the purchase of most goods and services, was originally set at 5 percent when introduced in 1998, before being raised to 7.5 percent by the Finance Act of 2019.

These proposed reforms come against the backdrop of a nation grappling with severe economic challenges, including skyrocketing food prices that have recently sparked protests across major cities under the hashtag #EndBadGovernance. Though intended to boost government revenue, experts like Dr. Audu Bello, an economist at Usmanu Danfodiyo University, Sokoto, argue that an increment of any tax at this time might backfire.

“Producers will never absorb these taxes; they’ll pass them on to consumers by raising prices,” Dr. Bello warned. “The masses will ultimately bear the brunt.”