Dear Advocate of Reasoning,

Welcome to another insightful edition of our newsletter, where we delve into critical issues affecting people and their nations. In this edition, we turn our attention to the pressing matter of the Nigerian economy entangled in a web of debt, with a focus on one of our insightful writer’s earlier articles titled “Economist Faults Nigerian Government’s Borrowing Plan, Recommends Spending Cuts.”

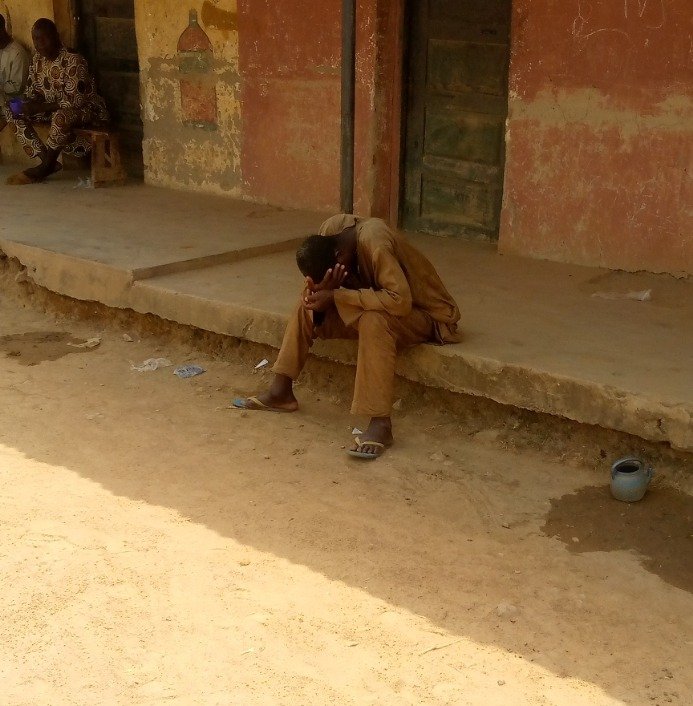

As Nigeria grapples with economic challenges, the mounting debt becomes a central concern. The intricate dynamics of Nigeria’s borrowing and spending strategies demand a closer examination to understand the potential repercussions on its economic future.

Recently, Nigerian President Tinubu has requested the Nigerian senate for approval to borrow more than N7 trillion from abroad as part of the federal government’s 2022–2024 external borrowing strategy. If approved, Nigeria’s national debt would rise to almost N94 trillion.

While the Nigerian debt is yet to cross or close to the threshold recommended by the World Bank, the move to borrow more than seven trillion naira to finance multiple sectors in the country is unpalatable. The problem with this decision is that President Tinubu is playing a bet, trading the nation’s future growth with unsustainable ideas of solution.

This is why one of our dedicated writers, brought forth a compelling analysis. The piece critically examines the implications of the government’s borrowing strategy and raises pertinent concerns about the long-term impact on the economy.

In the piece, associate professor Ahmed Adamu, from Nile University of Nigeria, condemned the government’s borrowing plan and recommended cutting the cost of governance as a way to manage the country’s resources. He astutely recommends a shift in focus towards spending cuts as a more sustainable approach. The piece spotlights the need for a recalibrated economic strategy that ensures long-term stability.

Taking a deep dive into the Nigerian economic landscape, there is a need for the government to adjust the flaws in its borrowing plan, and there is a need for a nuanced approach that goes beyond accumulating debt and instead focuses on essential spending cuts.

Catch up and we hope you do reason with us on this: “Economist Faults Nigerian Government’s Borrowing Plan, Recommends Spending Cuts.”