With the new tax reform Bills, Nigeria’s tax reform debate is heating up. A proposal to increase taxes on the rich has sparked a predictable clash between those who see it as a lifeline for public coffers and others who warn it will strangle the economy.

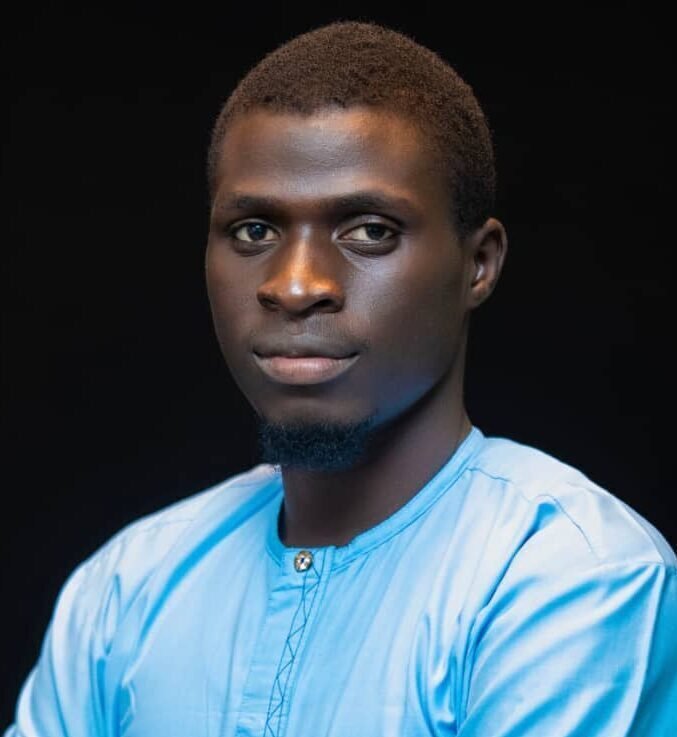

Kabiru Dandago, a professor of accounting at Bayero University in Kano, recently called on the government to slap higher taxes on luxury goods, property, and large transactions. Speaking on Trust TV’s Politics Today, he argued that scrapping the country’s Value Added Tax (VAT) in favour of taxing the rich “can give you two times what you are accepting from VAT.”

Dandago’s comment is a bold idea. It’s also a dangerous one.

Nigeria’s tax system is not short on levies targeting the wealthy, but its inefficiencies remain a critical flaw. The rich already contend with a tangle of taxes. Take the Education Tax, which claws 2 percent from companies’ annual taxable profits, raking in ₦1.7 trillion between 2011 and 2019. Or consider the Company Income Tax, which imposes a steep 30 percent rate on firms earning over ₦100 million, yielding ₦2.83 trillion in 2022—a 116 percent jump from the year before. Then there is the National Information Technology Development Levy, which extracts another 1 percent of profits from larger companies.

The problem, however, is not the rates but the system. Nigeria’s tax regime is a maze of overlapping demands and arbitrary enforcement. Kalaa Mpinga, chief executive of Mwana Africa, a pan-African resources firm, puts it bluntly: “Governments are very good at making up all sorts of taxes left, right and centre.” Such a chaotic approach undermines trust and risks cementing Nigeria’s reputation as an inhospitable place to do business.

Adding more taxes to the mix would only make matters worse. Instead, as Mpinga suggests, the solution lies in reform: “What you need, in fact, is to decrease and simplify the tax structure that the top companies and top earners have.” A leaner, more transparent system could improve compliance and foster a business environment where prosperity is taxed sensibly, not strangled.

A Punishing Environment

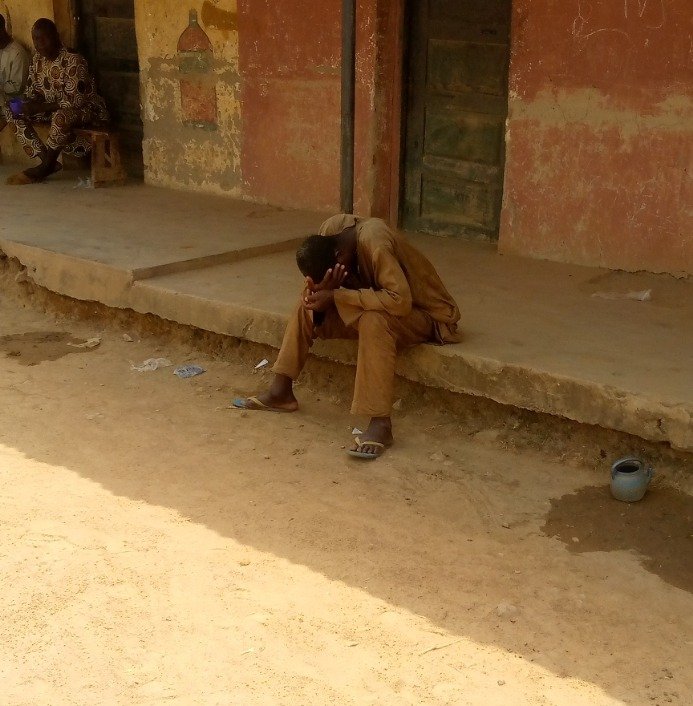

The signs of over-taxation in Nigeria are already evident. Over the past decade, at least 11 multinational firms, including South African retailer Shoprite, have either exited or signaled their intention to leave, according to a 2021 report. More recently, between 2021 and October 2024, over 50 companies have shut down or departed the country, taking with them thousands of jobs and millions of dollars in potential investment. Each departure compounds Nigeria’s economic woes, like the unemployment that ticked up to 5.3 percent in the first quarter of 2024 from 5.0 percent in the third quarter of 2023, while investment project withdrawals surged by 69 percent, according to the National Investment Promotion Commission.

The prospect of a wealth tax risks aggravating this precarious situation. Nobel Prize-winning economist Angus Deaton warns that such taxes often backfire, prompting the wealthy to hoard assets, evade taxes, or relocate to friendlier jurisdictions. For Nigeria, this could mean further capital flight, reduced investment, and an even weaker economy. Efforts to extract more revenue from the rich may inadvertently starve the economy of the very resources needed to drive growth.

In Nigeria’s current economic landscape—marked by rising unemployment, declining investment, and soaring inflation—creating a business-friendly environment is paramount. While calls from figures like Professor Dandago to increase taxes on the wealthy may stem from a desire to mitigate economic hardship, such policies often have unintended and damaging consequences.

“Tax the rich more” may be popular, but it’s no panacea. Nigeria’s economy is in desperate need of growth, and growth requires investment. Squeezing the country’s wealthiest firms and individuals could drive capital—and jobs—out of the country. It’s a risk Nigeria cannot afford.

Professor Dandago’s intentions may be noble, but his prescription could prove toxic.