Nigeria’s federal government moved to borrow more than seven trillion naira to finance multiple sectors in the country. The problem with this decision is that President Tinubu is playing a bet, trading the nation’s future growth with an unsustainable ideas of solution.

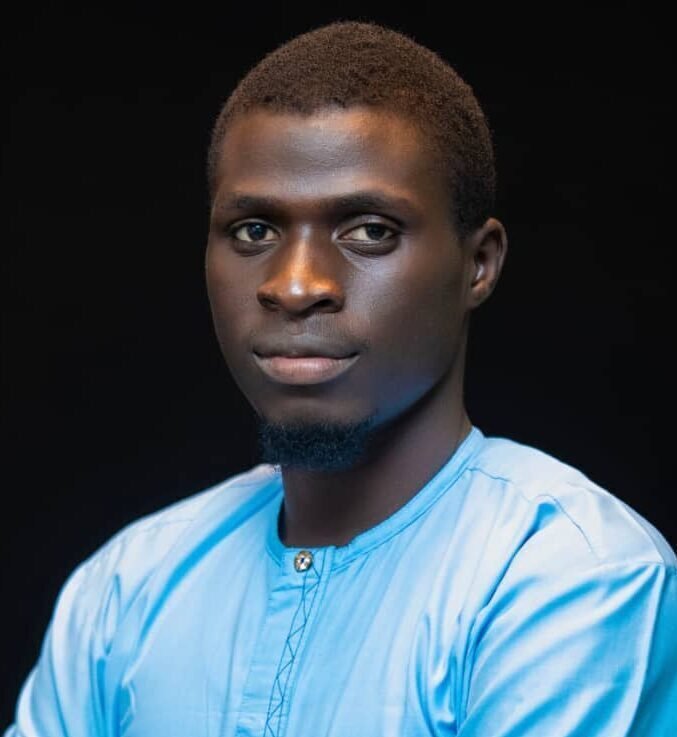

In video published on LinkedIn, Ahmed Adamu, a petroleum economist and associate professor at Nile University of Nigeria, took a critical look into the president’s plan. He condemned the government’s borrowing plan and recommended cutting the cost of governance as a way to manage the country’s resources.

“Excessive borrowing hampers future growth and perpetuates a circle of increasing debt,” he said. “Borrowing to fulfill today’s promises jeopardizes the fulfillment of promises for tomorrow.”

As part of the 2022-2024 external borrowing plan of the federal government, the president is seeking permission from the Nigerian senate to borrow more than N7 trillion from abroad, which will increase Nigeria’s public debt to over N94 trillion.

President Tinubu said the money would be targeted at financing infrastructure, agriculture, health, education, water supply, security, employment and financial management.

This is the second time the president will be requesting permission of the lawmakers to obtain foreign loan under the 2022 – 2024 external borrowing plan initiated by Mr Buhari before he exited office in May.

However, economist Ahmed Adamu faulted the plan of the federal government, tagging it as a weapon of destroying the future growth of the country. He said there are various alternatives that do not involve borrowing.

“One of the strategies is to stop trying to do a lot of things at once. If we do not have the money, we can prioritize. One thing can lead to another,” said Adamu.

The economist said instead of borrowing to do all many things at once, the government should commit the available resources to a few sectors.

He said: “Some sectors are more important than others. All these sectors are important but we can choose to prioritise and spend more on education, health, and infrastructure. And even in these, we can prioritise areas that are critical.

“These few sectors could facilitate other sectors so that a minimum budget could be spent on them. The most difficult thing is mostly the most important thing.”

“Let us focus on enhancing local revenue, especially by efficient utilization of revenue of savings from subsidy removal, the government can raise revenue by reducing the size and cost of governance and improving efficiency in spending.”

The petroleum economist recommended further that the government can explore mineral resources to generate revenue to finance those sectors.

“We are sitting on gold and several precious resources, and we are still borrowing. This is not sustainable. We should allow state to own and develop these resources so that they can finance these critical sectors by themselves. These projects are supposed to be the priorities of the state governments.

“The government may not have to fund all these sectors fully, but through a partnership with the private sector, it can fund these projects,” he said.