In 2011, Donald Kaberuka, then an executive of the African Development Bank, described Africa as a land of opportunity poised to propel global growth. More than a decade later, however, the continent’s economic engine is faltering, hindered by its own policymakers.

The Fraser Institute’s 2024 Global Economic Freedom of the World Index reveals a sobering picture of regression across African states. Zimbabwe ranks 164th, surpassing only Yemen—the least economically free country in the world. Sudan, Libya, and Algeria fare only marginally better. Alarmingly, many other African nations rank below 100.

Despite rank variations, a careful study reveals a common trajectory: economic restrictions imposed by leaders.

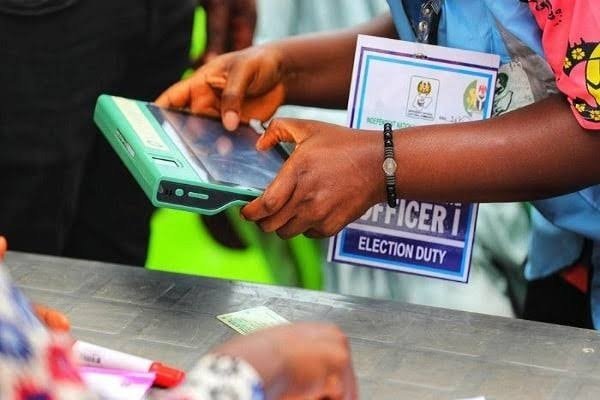

Nigeria, ranked 112th, exemplifies the pitfalls of misguided fiscal policies. Currently under consideration, the Nigerian Tax Reform Bill 2024 raises concerns among experts. Specifically, section 56 of the bill, aims to tax businesses with higher profits, consequentially taxing prosperity. Though the government defends the reform as necessary for revenue generation, history suggests otherwise. The World Bank attributes Nigeria’s declining Entrepreneurial Index score, now at 0.46 (down from 0.52 in 2023), to tax burdens that stifle competitiveness.

Kenya, ranked 111th, faces similar challenges. The Finance Bill 2024 introduced a slew of levies, triggering widespread protests. With youth unemployment at 67 percent among those aged 15 to 34, critics argue the bill unfairly shifts public debt repayment onto citizens who have no idea why the country needed to borrow in the first place.

Standing at the 153rd position is Chad. The country’s adherence to the Common External Tariff (CET) system under the Economic and Monetary Community of Central Africa (CEMAC), imposes a 30 percent tax on consumer goods imported from non-CEMAC countries. And in addition to its corporate tax rate of 35 percent, the country’s tax regime is among the highest in the region.

Common External Tariff (CET) is a tax scheme by the Economic and Monetary Community of Central Africa (CEMAC), an organization comprising six Central African countries. The International Monetary Fund described CEMAC’s tax system as a protectionist element for its local industries, imposing restrictions on non-CEMAC imports thereby eliminating competition.

In contrast with other member states, Chad’s corporate tax rate of 35 percent is also considered high within the CEMAC, with Congo having 28 percent; Central African Republic, 30 percent; and Cameroon, 33 percent. In its report, the Heritage Foundation faulted Chad’s high tax rates, stating that its regulatory inefficiencies significantly contribute to the country’s challenging business environment.

Zimbabwe’s ad valorem tariffs, taxes calculated as per the value of the product, can climb as high as 55 percent on private imports. A commitment to import substitution has led to bans on numerous items, ostensibly to protect local industries. However, the World Bank notes that these policies create a hostile environment for trade and innovation, further entrenching poverty.

Far from tax restrictions, several African economies suffer restrictions propelled by non-tariff barriers, protectionist measures other than taxation and import constraints. Notable examples include Zimbabwe and Zambia.

The International Trade Administration, in a 2024 report, describes Zambia, ranked 116th on the Economic Freedom Index, as a largely liberalised economy with minimal tariff barriers. However, trade impediments such as preferential treatment of local industries, intellectual property infringement, and an overly cumbersome, often arbitrary, and non-transparent regulatory environment hinder its economic growth.

Zimbabwe, ranked 164th, maintains one of the most protectionist trade regimes in Sub-Saharan Africa, a World Bank report says. According to the Zimbabwe Revenue Authority (ZIMRA), the country applies ad valorem tariffs of up to 55 percent on private imports.

The International Trade Administration reported the Zimbabwean government is generally committed to a policy of import substitution, imposing import bans on some items as a means to protect local industries.

Meanwhile, countries like Mauritius and Morocco, ranked 17th and 90th respectively in the Economic Freedom Index, demonstrate the benefits of prioritising pro-growth policies.

Mauritius remains the highest-ranked African nation in the index and is widely regarded as an economic success story in Sub-Saharan Africa. The nation has transformed from a low-income economy in the 1960s to an upper-middle-income country today. According to the U.S. Department of State, Mauritius owes much of its success to proactive implementation of pro-trade and investment policies, creating a favorable business environment, and facilitating international trade.

In the same category is Morocco. The country scores high in the “sound money” and “freedom to trade internationally” categories—securing above six and seven points, respectively. The North African country’s efforts to liberalise trade and investment policies have strengthened its integration into the global economy, propelling it from 97th in 2023 to 90th in 2024.

The U.S. Department of State attributes Morocco’s rise to initiatives such as its Investment Charter, adopted in December 2022. This reform significantly expanded incentives for foreign investment, helping Morocco attract the fifth-highest foreign direct investment (FDI) in Africa in 2022. The government’s focus on infrastructure development and foreign trade investment positioned the country as a regional trade hub.