Weeks of protest and agitation in Kenya have left several people dead and scores injured. Though Kenyan President William Ruto has now withdrawn his assent to the Finance Bill that sparked the public outrage, experts believe that more taxes provides no sustainable solution to the country’s problem. In agreement with the protesters, fiscal professionals say history teaches no country can reasonably tax itself to success.

Lenah Onyango, a partner at Cliffe Dekker Hofmeyr (CDH), a firm that specializes in tax dispute resolution, says the government needs an alternative approach as heavy taxation is not a solution to the challenges affecting Kenya.

“I am yet to see a country that has taxed itself to success. It is not about the numbers, but it is also about all the other factors that come into play to take us where we want to be as a country,” said Onyango.

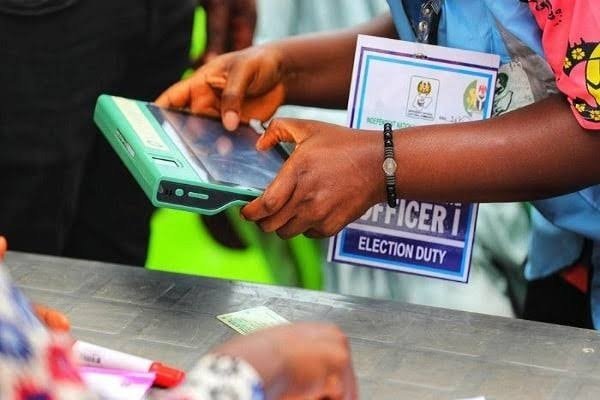

Introduced to the Kenyan Parliament in June, the Bill seeks to raise $2.67 billion revenue by introducing new taxes and inflating the existing ones. The government says such measures are necessary to fund its development programmes, reduce the budget deficit and deter the state from borrowing. For context, Kenya’s debt rose to 70 percent of the GDP in 2023 from 68 percent in 2021, a number higher than the 55 percent recommended by the International Monetary Fund (IMF) and the World Bank.

Taiwo Oyedele, the chairman of Nigerian Presidential Committee on Fiscal Policy and Tax Reform, states that if not properly considered, taxation might give adverse results and hurt the economy. For instance, “Africa’s large informal sector shouldn’t be targeted for tax extraction. Instead, it should be seen as a massive opportunity to drive growth and create wealth.

“Think of these businesses not as fruits to be harvested in the immediate term, but as seeds to be nurtured for inclusive development in the medium to long term,” he said.

A study by Stransact, an independent Audit, Tax, and Consulting firm, reveals that multiple taxation creates an unfavorable business environment, stifles investment, and ultimately leads to the closure of businesses. According to the study, small and medium-sized enterprises (SMEs) are particularly vulnerable to this phenomenon.

The study stated that over-taxation increases the cost of doing business as businesses would be forced to pay several taxes and levies to different levels of government, thus increasing their operating costs and reducing their profit margins. This makes it challenging for businesses to survive, particularly during tough economic times.

“Multiple taxation leads to reduced competitiveness. When businesses are subject to multiple taxes and levies, it reduces their ability to compete with businesses operating in other countries,” the study reveals.