South Africans have recently received some good news. A primary fiscal surplus, a credit rating upgrade, and the end of loadshedding. It’s an unusual feeling given the depressed state of the economy in recent years. While these are welcome developments, we should set our sights even higher.

Last week’s Medium-Term Budget Policy Statement (MTBPS) revealed some positive indicators about the state of South Africa’s public finances. It was hardly a hawkish budget: approximately 60% of spending is still dedicated to the so-called “social wage” (health, education, and welfare) and a further 20% on debt service costs (Treasury pays over R420 billion a year to its creditors, more than R1 billion a day).

All this spending is supported by a mere 7.8 million taxpayers struggling through an economy that isn’t growing and hasn’t really grown for more than a decade. The burden is unevenly shared: those earning more than R750 000 per year pay 60.6% of all personal income tax, according to the Centre for Risk Analysis.

However, Finance Minister Enoch Godongwana last week announced that the consolidated budget deficit is projected to decline from 4.8% to 4.5%. Revenue is expected to exceed non-debt expenditure by R19.3 billion, resulting in a primary budget surplus of 0.9%.

Consequently, sovereign debt is set to stabilise at 77.9% in 2025/26. This is still very high compared to the mid-2000s, when debt levels went as low as 24%, but in a global environment characterised by fiscal dominance, South Africa’s debt burden is lower relative to other countries – particularly in the developed world.

The primary surplus now gives Treasury an opportunity to reduce debt to more sustainable levels and to lower overall expenditure. This is wise. As any financial advisor will tell you: pay off your debts before you do anything else.

Price relief

The most welcome news to come out of the Mini-Budget was the announcement of a revised inflation target from a range of 3 – 6% down to a more precise 3% (with some wiggle room on either side).

This comes close to a recommendation made by the Free Market Foundation this time last year to reduce the target range to 0 – 3% and after ongoing lobbying by Governor of the South African Reserve Bank, Lesetja Kganyago. He should be cheered for getting his way.

Many South Africans might intuitively feel that their basket of groceries is getting more expensive than 3% a year and would be right to maintain some scepticism about the how the Consumer Price Index is calculated. Nevertheless, the revised inflation target is an important signal of intent by the government to keep prices low and to protect the value of the currency.

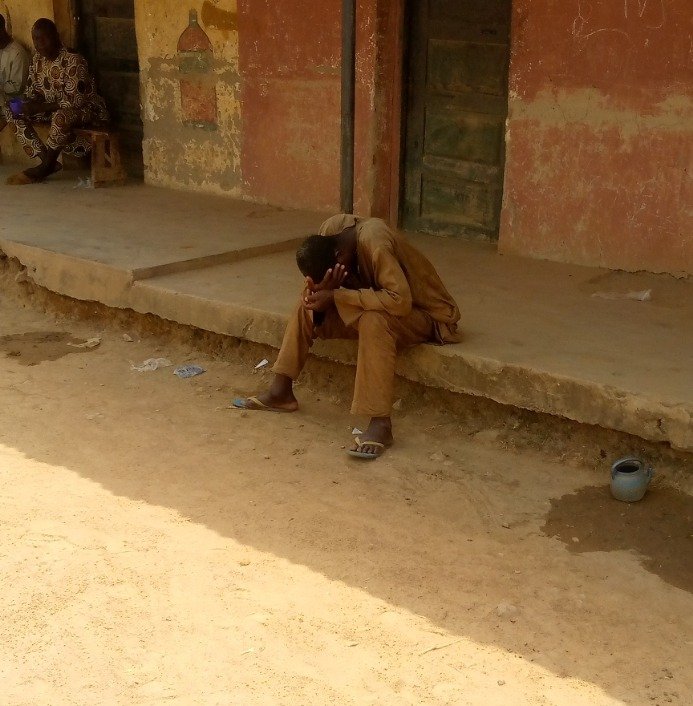

Inflation is a great destroyer of wealth and hits poor people hardest. In a country with such high levels of poverty, keeping prices low should therefore be an urgent priority. Unfortunately, South African consumers remain burdened by high administered prices such as fuel levies, which contribute to the high cost of living.

The true test of future budgets will be if savings can be translated into tax cuts. Reducing taxes would free up South Africans to invest in productive activities that would generate more wealth for themselves (and others). This would in turn stimulate higher economic growth and set in motion a virtuous cycle of increased revenue and lower debt.

Balance of forces

The relative conservatism of last week’s MTBPS is a result of the highly contested Budget process earlier in the year, which took three attempts to pass. I have been a vocal critic of the Government of National Unity (GNU), but the high-water mark of the GNU era was the conflict over the proposed VAT increase that precipitated the Budget delays.

The incident revealed that a coalition should be premised not on cordial relations between the partners in the government, but on a recognition of the competing interests that each party represents – and a willingness to fight for those interests.

To this end, I am encouraged to see the Democratic Alliance (DA) also adopting a critical stance towards Black Economic Empowerment (BEE) with its proposed alternative, the Economic Inclusion For All Bill. BEE is clearly the greatest obstacle to growth in South Africa. It lies upstream of many other problems affecting the country and is a policy that needs to be entirely undone.

We hope to see an even more rigorous opposition to new tax proposals in the 2026 Budget from within the GNU, and tangible steps by DA and other non-African National Congress (ANC) ministers in the GNU to end BEE in their portfolios with or without the assistance of their ANC colleagues.

Afuera!

South Africa seems to be pointing in the right direction, but will it start moving in that direction?

A few weeks ago, I reflected on the staggering pace of reform and fiscal consolidation taking place under President Javier Milei in Argentina. In a short two years, Milei’s administration has reduced government spending by around 30% and recorded the first fiscal surplus in 123 years. He did this through aggressive liberalisation, and by removing thousands of unnecessary laws and regulations. Growth is up, inflation is down, and investors are returning to Argentina.

This is the kind of shock therapy that South Africa needs.

Don’t get me wrong, I am not in the habit of looking gift horses in the mouth. I prefer less spending to more spending, and lower debt to higher debt, so last week’s MTBPS was the best I’ve seen in a long time. I can retain my libertarian principles while recognising that politics is the art of the possible.

However, if this is how markets react to some modest fiscal consolidation, imagine what could be achieved through more aggressive reforms?

South Africa’s economy is blessed with deep and diverse domestic capital markets, a sophisticated services sector, and an abundance of natural and human resources. Our potential is limitless and there is a veritable ocean of domestic and international capital eagerly waiting to be deployed here.

Don’t delay

However, circumstances can change very quickly, and, like a recovering alcoholic, the government is only one binge away from falling off the wagon once again.

With the local government elections on the horizon, and the ANC still reeling from last year’s poor showing at the polls, the temptation to reopen the spending taps might be too great for the government to resist. Alternatively, an unexpected exogenous shock on the scale of the Global Financial Crisis or the Covid-19 lockdowns could see the window for reform slamming shut once more.

While the GNU partners seem content to play the long game, I would warn that time is not on their side. At the very least, the GNU is likely to come to an end in 2027 when Cyril Ramaphosa finally steps down as President of the ANC. If Paul Mashatile takes his place, he may not be as keen on holding the GNU together.

Given this, I remain convinced that South Africa requires boldness rather than incrementalism. Now is the time to fire up the chainsaw.

________

David Ansara is the Chief Executive of the Free Market Foundation.